At APT Legal, we’re often asked what happens if someone passes away without a Will. Recently, we shared a social media post highlighting the Rule of Intestacy, a legal framework that dictates what happens to your estate when you die without a valid Will. If you haven’t made a Will, this could significantly impact how your assets are distributed — potentially in ways you never intended.

In this article, we’ll explain how the Rule of Intestacy works, why it’s essentially a “government Will”, and how you can take control of your own estate by writing a legally binding Will. We’ll also explore the pitfalls of not writing a Will and who could miss out if you don’t act.

How do the Rules of Intestacy Work?

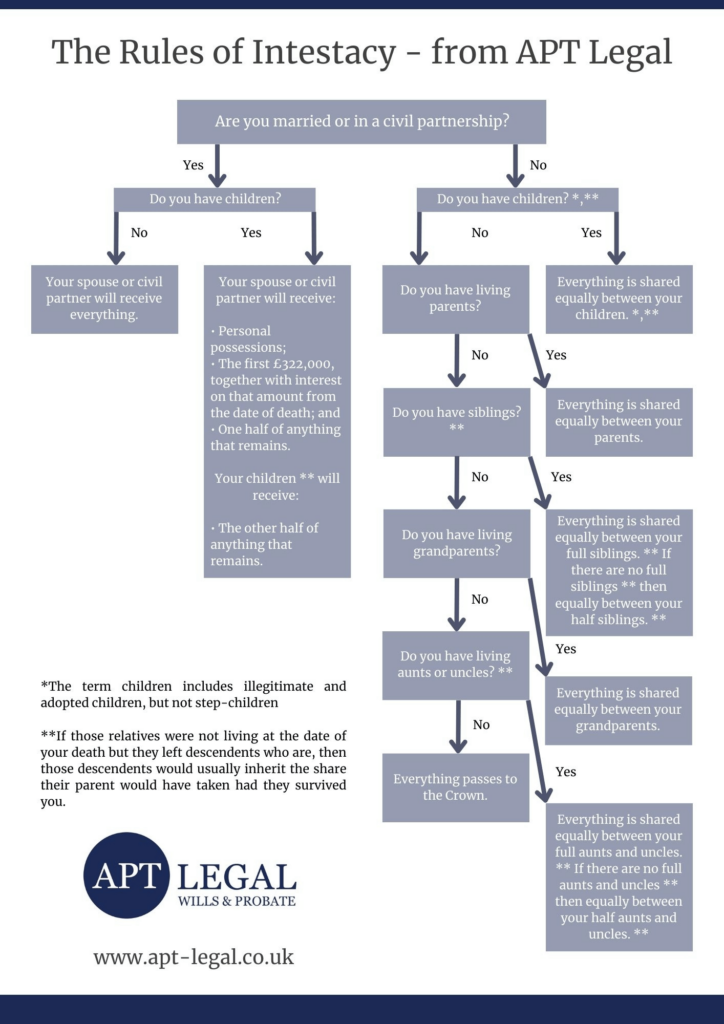

When someone dies without a valid Will, their estate is distributed according to the Rules of Intestacy. Under these rules, a strict hierarchy of inheritance take place and specific relatives are set to inherit depending on the size and value of the estate. Essentially, the government steps in to make these decisions, leaving you with no say over how your property, money, and belongings are passed on.

In England and Wales, the law prioritises certain family members over others, regardless of your personal wishes. For example, if you are married or in a civil partnership and die without a Will, your spouse may inherit the bulk of your estate. However, if you are unmarried and cohabiting, your partner might receive nothing, as cohabitation isn’t recognised under the Rules of Intestacy.

Children, parents, and even distant relatives might end up with your assets — or if no qualifying relatives can be found, your estate could revert to the Crown. The idea that the government could decide who inherits your hard-earned assets is one many people find unsettling.

Taking Control by Writing a Will

The good news is, you don’t have to leave the future of your estate to chance. By writing a Will, you take control of where your assets go after your death. You can decide who receives your money, property, and belongings, ensuring your loved ones are cared for in line with your wishes. This also allows you to make provisions for friends, partners, or even charities who wouldn’t necessarily be recognised under the Rule of Intestacy.

At APT Legal, we provide expert Will writing services to clients across England and Wales, helping you take charge of your estate planning. By creating a Will, you:

– Ensure your loved ones are provided for: You can specify exactly who should inherit your estate, rather than leaving it up to the government.

– Avoid family disputes: A clear and legally binding Will reduces the likelihood of disagreements between family members over inheritance.

– Appoint guardians for your children: If you have young children, your Will can outline who should care for them if the worst were to happen.

– Minimise Inheritance Tax: With the right planning, your Will can help reduce the amount of Inheritance Tax your beneficiaries might need to pay.

– Support charities: You can leave part of your estate to a charity close to your heart, which wouldn’t be possible under the Rules of Intestacy.

The Pitfalls of Not Writing a Will

Not writing a Will can lead to significant challenges for your loved ones. Without one, your estate will be governed entirely by the Rules of Intestacy, which can lead to outcomes you never intended.

For example:

– Unmarried partners: If you live with a partner but aren’t married or in a civil partnership, they will not inherit anything under the Rule of Intestacy, no matter how long you’ve been together. This could result in your partner losing their home or financial security.

– Stepchildren: Similarly, stepchildren are not automatically entitled to inherit under the Rules of Intestacy, which could leave children you’ve cared for with no inheritance.

– Estranged relatives: The Rule of Intestacy doesn’t take personal relationships into account, meaning estranged or distant relatives could inherit your estate if no other qualifying relatives exist.

– Assets passing to the government: If you don’t have any close family members, your entire estate could end up with the Crown — which is unlikely to be your preferred outcome.

Who Could Miss Out?

Without a Will, those who matter most to you could be left without support. Unmarried partners, stepchildren, friends, and charities are all vulnerable to being overlooked under the Rule of Intestacy. By not writing a Will, you run the risk of leaving loved ones unprovided for, and your estate may not be used in the way you’d intended.

In addition, without clear instructions, disputes over your estate could arise, leading to lengthy and expensive legal battles. Writing a Will ensures that your wishes are clearly outlined, reducing the risk of conflict and ensuring your assets go where you want them to.

Take the First Step Today

At APT Legal, we’re here to help you avoid the pitfalls of intestacy. Our experienced Will writers offer a professional, tailored service to clients across England and Wales, ensuring your Will reflects your personal circumstances and wishes. Don’t leave your estate in the hands of the government — take control today by writing a Will, and ensure your loved ones are protected.

To learn more about our Will writing services, or to arrange a consultation, take a look around our website or get in touch with one of our team members. It’s never too early to plan for the future, and with APT Legal by your side, you can have peace of mind knowing your estate will be handled exactly as you intend.

Here is the intestacy flowchart: